As the world of trading evolves, Depth of Market (DOM) trading has emerged as a powerful tool for those seeking a deeper understanding of market dynamics. Diving into DOM trading can seem daunting at first; a sprawling array of numbers and fluctuating prices creates a complex tapestry that requires careful navigation.

However, with the right guidance and strategies, traders can harness the potential of this robust approach to gain an edge. Whether youre a seasoned investor looking to refine your skills or a newcomer eager to make your mark, this article unveils essential tips to help you confidently embark on your DOM trading journey.

Get ready to unravel the mysteries of market depth, enhance your decision-making skills, and elevate your trading game to new heights!

Understanding Depth of Market (DOM) Basics

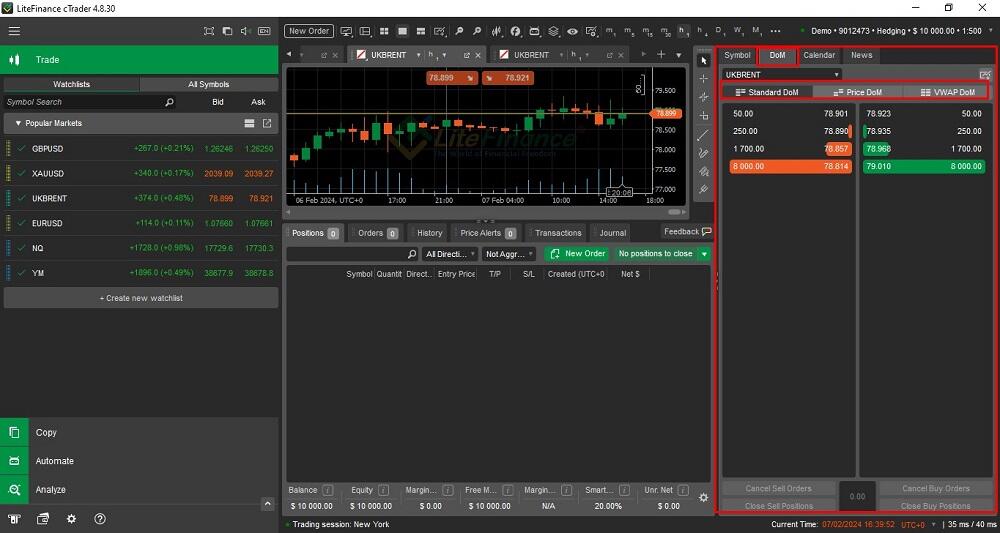

Understanding dom trading is essential for traders who wish to navigate the complexities of market dynamics effectively. At its core, DOM provides a real-time view of buyer and seller orders for a particular asset, showcasing the price levels at which participants are willing to trade.

This fascinating tool doesn’t just lay out numbers; it reveals the emotional pulse of the market, highlighting areas of support and resistance that seasoned traders know can shift swiftly. Picture a bustling marketplace: some buyers are eager, bidding high, while others stand back, waiting for the right moment.

Similarly, DOM reflects the ebb and flow of trading sentiment, illustrating how deep the order books go and where liquidity lies. By grasping these concepts, traders can make more informed decisions, capitalize on fleeting opportunities, and refine their strategies with nuanced precision.

Monitor Market Depth Regularly

Monitoring market depth regularly is a vital practice for any trader looking to navigate the complexities of Depth of Market trading. By keeping a close eye on buy and sell orders at various price levels, you gain a nuanced understanding of market sentiment and liquidity.

This insight enables you to identify crucial levels of support and resistance, helping you make informed decisions in real time. Its essential to look beyond the surface; fluctuations can occur rapidly, often catching even seasoned traders off guard.

Engaging with market depth data not only sharpens your strategies but also fosters a keen awareness of potential volatility. Remember: patience and vigilance are key.

The market can shift in an instant, and those who are well-informed stand a better chance of capitalizing on fleeting opportunities.

Control Your Emotions

Controlling your emotions is paramount in the high-stakes world of Depth of Market trading. The thrill of rapid price movements can easily lead traders astray, spiraling into impulsive decisions driven by fear or greed.

Imagine, for instance, watching a stock soar and feeling the exhilarating pull to jump in at the peak—yet, its often at that moment when the smartest move is to step back, analyze, and maintain composure. Developing a disciplined mindset is essential; this means setting clear trading plans with predefined entry and exit points.

Taking a moment to breathe, reflecting on your strategy before acting, can mitigate the impact of emotional trading. Remember, it’s not just about the numbers; it’s about cultivating a steady hand amid the chaos, ensuring that each decision is grounded in logic rather than fleeting emotion.

Conclusion

In conclusion, delving into Depth of Market (DOM) trading can be a rewarding endeavor for those willing to invest time and effort into understanding this intricate aspect of the financial market. By grasping key concepts such as market depth, order flow, and the nuances of liquidity, traders can enhance their decision-making process and improve their overall trading performance.

As you embark on your journey into DOM trading, remember to practice with a demo account, stay disciplined, and continuously educate yourself. With the right mindset and strategies in place, you can leverage the insights gained from depth of market analysis to make informed trades and achieve your financial goals.